Why is Square buying Afterpay?

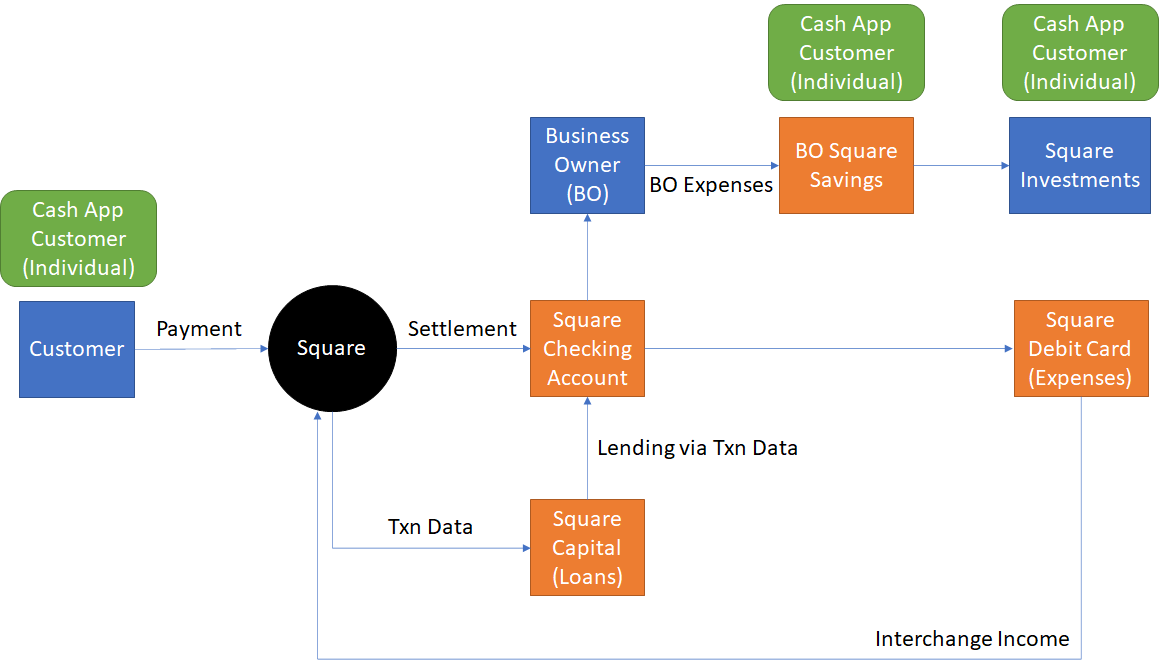

Last Saturday, we came out with the reason Square was really wanting to be a bank and the how's and what's of the same. And if you noticed, there was an image with the entire ecosystem play with small green boxes on top of existing blocks of the ecosystem representing the cash app (below for reference).

Little did we know that 1 week later, Square would end up buying a vertical standalone BNPL provider Afterpay (subject to regulator approvals)!

Deja Vu.

The above image really sums it up well wrt the real reason Square (an established player with no dearth of capital, tech expertise) will want to spend an exorbitant sum (or is it) to buy a standalone BNPL provider. Well the numbers suggest otherwise.

The BAU economics looks pretty mundane, build vs buy and sorts. But if we deep dive into the unit economics and the inherent value of the entire transaction chain built by Afterpay (or for that any other standalone BNPL provider), only then we realize this was a pretty smart move for a bank.

Metrics

The quoted price was $29 Billion in all stock deal (swapping stocks of Square with Afterpay). So technically no cash exchanged hands. This is easily recoverable considering the growth trajectory (and the recent banking charter approval) that Square has been on. A 20% uptick in current valuation levels of Square will recover the cost (considering the dilution because of fresh issue of shares) of the purchase. At current valuations (closing prices as on the day of writing) Afterpay ($29 B) is costing appx 22% (29/130)of the value of Square ($130 B).

Data from Annual, Quarterly reports of Afterpay / Square:

- Purchase Price : $29 Billion

- Total Merchants on the Platform : 100,000

- Total Customers on the Platform : 16 Million

- CAC : $1800 (29000 / 16)

- Afterpay Merchant GMV (LTM as of H1-2021) : $16 Billion

- Afterpay Revenue : $700 Million

- Net Take Rate of Afterpay (Charges) : appx 5% (700/16000)

- Net Revenue Per Customer : $44 (700/16)

- Net GMV Per Customer : $1000 (16000 / 16)

The inherent metrics is where the things get interesting and with a long term view it can be beyond justified (some of you may prefer to call it a bargain deal as well).