BNPL Business Economics, Future & Value Unlock

Loans have been around for almost as long as money has been around. Why specifically now has the concept of BNPL (Buy Now Pay Later) picked up so much steam and attracted investments (retail and institutional)? The answer lies in the insatiable consumption demand and prioritizing instant gratification over long term convenience (be debt free) of the buyer!

This is an old product with a new packaging. Worldwide the forms of this product are many. The model is pretty straightforward, reward the user (borrower) by not charging any interest and charge the retailer (seller) similar to credit cards. Here's the distinction and the real kicker - this product is omnipresent! It's a payment instrument without any physical form, a truly cloud native product which runs on APIs.

Here's an example for the uninitiated:

- Price of Product : $500

- Pay in 4 : $125 x 4 (i.e. interest free)

- Pay in 8 : $62.5 x 8 + Interest as applicable

- Here the 4 or 8 will depend on the tenure of the loan (can be 4 weeks, 4 months etc.)

Economics of BNPL Business

BNPL as a standalone offering is not too different from typical loans (invoice purchase, checkout financing etc.) to understand how the real value will unlock we need to look at the BNPL ecosystem which caters to:

- Consumer (Buyer)

- Retailer (Seller)

- Re-Financer (Bookrunner - the entity who lends money to BNPL companies)

- The Larger Company itself (BNPL Providers, called "Provider" hereon or it's Parent/Group Companies)

- Investor (VC / PE etc.)

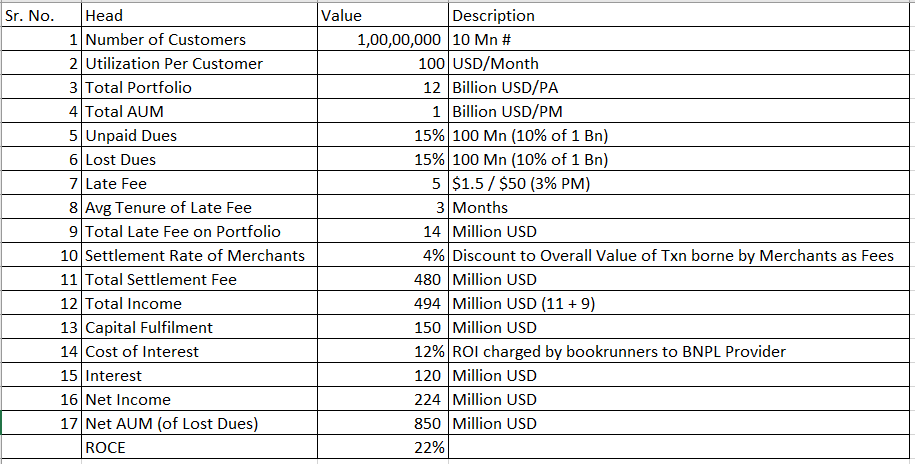

Economics for the Bookrunner and the Provider

The above is a typical back of the envelope calculation just to illustrate the economics of the entire book of BNPL. Some numbers might be off depending on the market, BNPL provider, Bookrunner etc. Also there will be other expenses of running the business like discounts, marketing, employee expenses etc. The ROCE is just a metric to evaluate the profitability of a legacy book which will keep on running for time to come (from 1 customer to another and from 1 pay in 4 to many and so on).

The bookrunner will enjoy the benefits of interest income (14,15 in above image) coming from lending the money as a corporate loan to large provider.

The loss rates (written off rates) are a tad bit high as well (6) but just to illustrate at maximum write off at 15% of the book (meaning 15% of principal erosion which will need to be repaid back to the bookrunner (13)) the ROCE still is quite high.

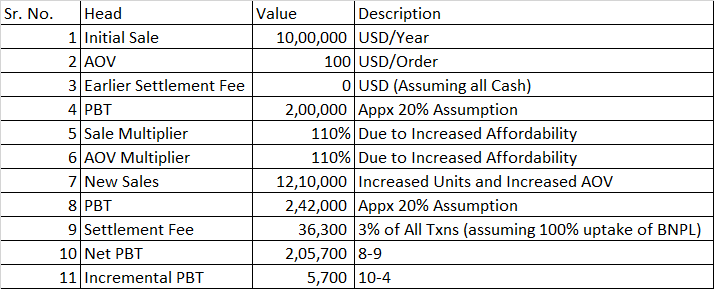

Benefits to the Retailer (Seller)

The seller who is bearing the cost of the loan to the customer is at loss of 4-8% depending on the provider and the sellers industry but the same is compensated more than fairly considering that affordability (what the customer could not afford earlier because of low cash + friction to buy using own cash) goes up and the average order value also increases in tandem.