Thrasio Business Model's VC Investment Thesis and its Global Peers

About the Thrasio Business Model

Thrasio is the newest vertical tech company on the block. Well this statement might be partly true since this new business model (and the company) has been in existence for quite sometime now. Earlier in the day (2017 and prior) these companies used to be called as E-commerce enablers (or this framework of purchasing these brands was called the Acquisition Entrepreneurship Framework) which was not as fancy as "E-commerce Roll Up" thus did not attract too much venture capital as it should have.

To be fair, this pandemic has led to a hockey stick growth for internet first, digital born, D2C brands (Direct to consumer brands of physical goods) which has led to VC money chasing these roll up companies like Thrasio.

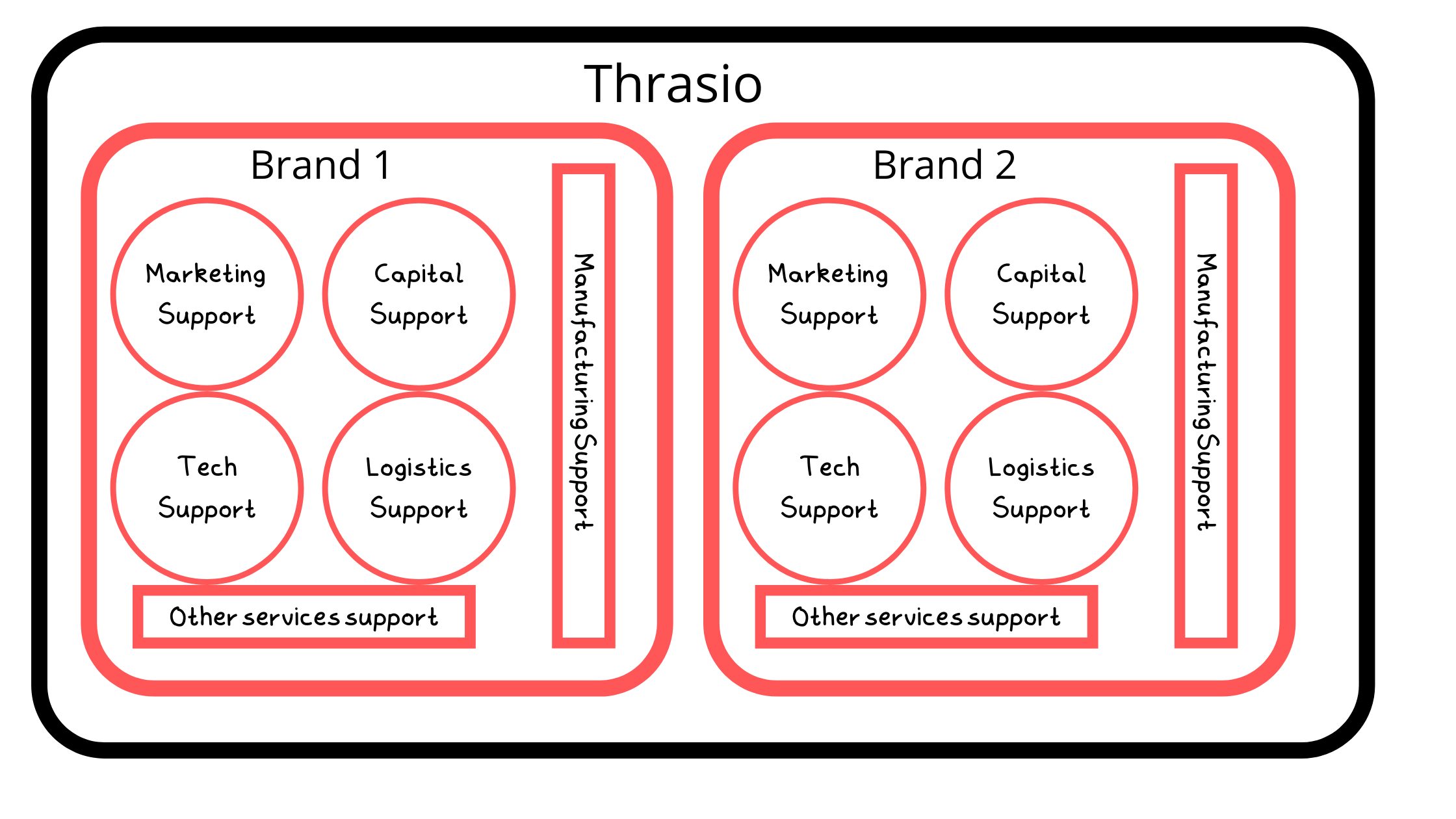

The above image summarizes Thrasio Business Model too simplistically - What they do is buy Hot Selling, Profitable (or any business that can be turned profitable), D2C Brands that depend on the Amazon (or any other marketplace) ecosystem to sell their products to customers without the need of physical storefronts (or in some cases physical storefronts as well).

What used to happen for such Brands before the Thrasio Era?

Well, before Thrasio, such businesses were supported by independent outside service providers (and internal talent pool) for various activities involved in running the Business. Refer to the E-Commerce Roll Up Concept for more details.

In over simplistic terms consider Thrasio as a mini VC / PE who funds the D2C Brands which sell on Amazon or other marketplaces or directly via their website and guides them on their growth journey with all the firepower (capital / experience / tools) that they have.

Economics of E-commerce Roll Up

For the rest of the analysis we would focus on roll up companies in general and would refer them as ERUP brands (E-commerce Roll Up Brands).

The economics of this model is quite complex due to the nature of the business which relies on purchasing brands across industries (which in turn have completely different economics). However the fundamental principle of ERUP companies is the same - Pay a multiple of Revenue or EBITDA to the entrepreneur who has built this business (as an exit option) + (not in all cases) a recurring fee for each sale (royalty) till a pre-defined period / lifetime as the case maybe.

The important part here is not just rolling up companies, but actually which companies to roll up. This part is probably the hardest, post identification the execution starts which most of these organizations are quite adept at and the same is fairly templatized. Below is a sequence which these companies typically follow to the T (as in a template) to evaluate and close these companies.

- Identify potential brands (using data such as reviews, ratings, sale data, brand recall, IP of the owner etc.)

- Outreach to the Brand owners

- Due Diligence

- Reject / Negotiate & Offer Term Sheet

- Closing the Sale, Legal Paperwork, Releasing Funds

- Integrating the Brand in their Organization Umbrella (Typically 1-6 take about 45-60 days)

- Growth and

- Repeat...

The identification is done using various parameters that evolve over time and the type of brands are also different for different ERUP companies out there. Some rely solely on D2C Brands (with self platforms like Website, Shopify, Social etc.), Marketplace sellers (Amazon, FBA (fulfilled by Amazon) sellers only), Vertical (Consumer Products - FMCG, Electronics, Accessories, Jewellery, Cruelty Free Cosmetics, Clean Fashion, Pet Products etc.).

When it comes to success in the Roll Up space, the company that has the most robust buying process will eventually sustain and breakout of the herd. Because when you have good money chasing bad money (too many brands at higher valuations), it will mostly be all money down the drain. Imagine this, when an Amazon FBA Seller is contacted by 200+ buyers for his business including the likes of Roll ups, Family offices, Competitors, HNIs, Large Brands (wanting to get into the space) then it becomes a Sellers Market (where the Amazon FBA seller can command a price desirable to them for selling their business by pitting 1 buyer against the others). This is when this buying spree will become unsustainable.

Payouts to brand owners will typically be market rate multiple for their topline. Let's take the example of Angry Orange Pet Odor Remover. This is an Amazon seller that was doing close to $2 Million in Annual revenue on Amazon. Below are the economics of the Txn:

- Total Revenue : $2 M

- COGS : $800K (appx 40% for a manufacturing business)

- Amazon Cut : $400K (appx 20% for FBA Businesses)

- Other Expenses : $400K (appx 20% including legal, accounting, marketing etc.)

- EBITDA : $400K (20%) [Net income of an small owner would be lower due to Taxation]

- Thrasio Paid to acquire : $1.4 M (3-4X of EBITDA, Appx 5 Yr DCF Model) + Royalty (unknown %) [Mostly in case of IP]

- Post Purchase Revenue : $16 M (8X Growth)

Now Imagine the scale at which a company with billions of dollars (or VCs, PEs) to invest can do in such an ecosystem.

- Investable corpus : $1 Billion

- Average (called Avg hereon) Purchase Price : $5 M

- Total Businesses to Purchase : 100 (target)

- Total Corpus spend Purchasing Businesses : $500 M

- Avg Pre Purchase sale of Businesses : $5 M (@20% EBITDA, 5X Purchase Price)

- Total Sales : $500 M ($100 M EBITDA)

- Avg Post Purchase Multiple (of 20% Businesses) : 10X

- Avg Post Purchase Multiple (of 80% Businesses) : 2X

- Total Sales (Post Purchase) : $ 1 Billion ($100 M * 10) + $800 M ($400M * 2) = $1.8 Billion

- Avg Incremental EBITDA (due to economies of scale, better inventory planning, low CAC etc.) : 5%

- Total EBITDA : $450 M (25% * $1.8 Billion) i.e. 4.5X Growth (This can translate into pure bottom-line as well considering this ERUP company will be a large organization who is capable of shielding wealth from Taxman + will also get benefit of amortization of investment over 3-5 years)