Modern Money Movement Business Models

A little context about the money movement business. This is not physical movement of money. This is about the rails that power the movement of money from one point to another via systems thereby leaving a trail behind in the form of SOR (statement of records). You might not be thinking about this when you are paying that business via a credit card or any other preferred mode. The entire system at the back ensures that funds are debited/credited to correct parties.

There are many parts about the money movement that are businesses in itself, but today we will see a very specific line of business which is getting unbundled with tech. This is the payouts and receivables management space.

What is Payout Management

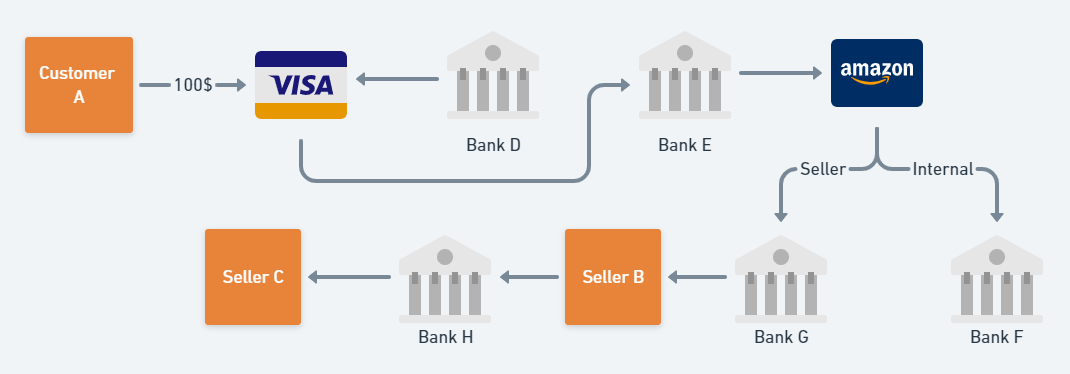

Let's take an example of a large marketplace like Amazon. Amazon has hundreds of thousands of sellers, and hundreds of millions of customers across the globe. Now imagine a scenario where a customer A buys a product X from Seller B who in turn buys the raw material required for making X from Seller C (outside of Amazon). The payment flow will be as below:

- Customer makes payment via Credit Card issued by Bank D

- Bank D settles the payment to Bank E (Amazon's Bank)

- Amazon's Payments Team (more on this later) settles the payment in two parts in different accounts - 1 in their internal revenue account (with Bank E or any other Bank F - we will take Bank F which is Amazon's share of sale) and the other part in the Seller B's Bank G

- Seller B then transfers money from Bank G to Seller C's Bank H

If you are lost already, please read this line - This is too much of an oversimplification. There are 100's of processes (people intensive) and systems running at the back ground with much more funds routing to ensure this runs like a well-oiled machine. Imagine this is only a purchase transaction (a Happy journey) for a single product from a single seller. Pls don't even get me started on what happens when a single customer buys 2 or more products from multiple sellers and returns one of them (gets a full refund), gets a partial refund for product 2 and keeps the product 3 with her/him.

If you are with me till now, pls have a look at this image for better clarity.

The moment the user made a payment all of the systems and manpower at the backend got into action to ensure that Visa, Bank D, Bank E, Amazon, Seller B, Seller C got their desired share of payments.

This is called payout management or reconciliation, or money movement etc. To your surprise you would see lot of large tech companies or those companies who move a lot of cash through the system have a dedicated team called central recon team or payments team or something to do with payment ops. Yes, a lot of livelihoods are resting on a problem that tech could have solved or is already solving!