Economics of Cross Border Remittance with and without Blockchain

Much has been said about the FinTech evolution worldwide, with behemoth rounds of funding and the newer use cases and business models evolving at rapid pace. FinTech seems to be taking the startup world by storm.

But something is common across global markets - all FinTech solutions cater to their individual geographies (well mostly). This essentially means that the FinTechs cater to the prominent use cases inside of the geography they operate in and do no cater to cross border solutions i.e. Remittances.

There are good reasons that is so. Barring the likes of Wise, Nium, Remitly, Flywire etc. there is hardly anyone that has broken into the infrastructure of remittance business. There are a number of startups and tech companies in the remittance side but most of them rely on the legacy infra in some shape and form to achieve the outcome. This is the infra that seriously needs an upgrade considering 7-9% of value loss in the transaction due to inefficiencies.

To dive into detail we will first look into what Cross Border Remittance (CBR) is, the current rails on how it works, the economics of the current transaction and how blockchain is building the rails that will power the future of remittance.

What is Cross Border Remittance

Remittance is a fund-transfer transaction wherein funds are moved from one account to another account within the same or any other financial institution. Cross Border Remittance is the act of fund transfer between two accounts situated in 2 different countries.

The complexity of this business is primarily due to the large number of permutations of currency pairs. Since you as a remitter (sender) can send your X currency (which can be any amongst the 180+ recognized by UN at the time of writing this article) to any other receiver in Y currency (which can also be any amongst the 180+ currencies recognized by UN) - the number of permutations can be 180P2 i.e. 32000+. These combinations are called as currency corridors in banking terms.

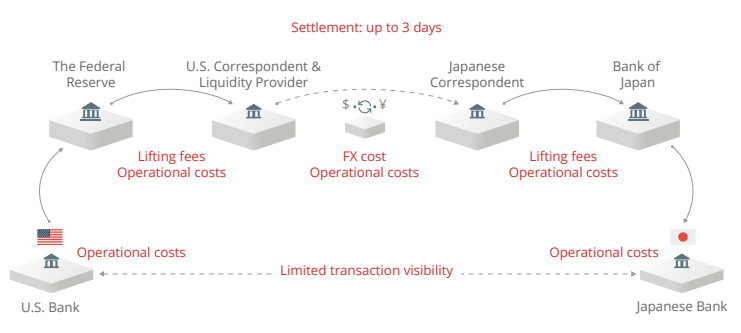

Since the process involves lot of steps like connecting bank of currency X to bank of currency Y and since not many banks across the globe have operations of the size of large ones like BankAm, HSBC etc. the small banks have to introduce other banks who can act as the currency holder / converter for them (this is too much of an oversimplification, details below). Adding more and more intermediaries will increase the inefficiency in the process thereby adding the time and charges required for the remitted amount to reach the receiver.

How does Cross Border Remittance Work

CBR is based on a Ledger Concept where the sender and receiver maintain the ledger on account of the remitter so that the receiver can verify the receipt of funds and can proceed with the next leg of the transaction. This can take days on account of difference in working hours/days etc.