Democratizing Investing Part 4 - Uncorking Wine as an Asset Class

During the last 2 years (while in the Pandemic), alcohol sales zoomed past all other products (maybe not as high as sanitizers) as billions of people locked themselves inside their homes. This rise in alcohol sales is an indicator of Quality Alcohol (wine and whiskey predominantly) as an asset class i.e. investment opportunity which retail investors (consumers of alcohol) typically buy and consume rather than buy and "hold".

The problems associated with buy and hold/store are many, prima facie the storage and that too in climate control environments! This is what has been for long stopping retail participation in Wine or Whiskey as an asset class. This might as well be, one of the most resilient asset class, yet, because when times are good, people drink and when times are bad, people might drink even more!

It is also one amongst the most "liquid" assets (pun aside). Not only from a pure play asset liquidation perspective (because you will eventually find a buyer who can hold on to the asset even longer), but also from self liquidation perspective (consumption). Thus this asset class has for the longest time been a serious investible option for the high income segment who may even have dedicated cellars in place to store Wines of different vintages. It's like the immortal Cartier timepiece that's sort of handed down generations to either hand down further or liquidate (sell or consume).

How does Wine Investment Work

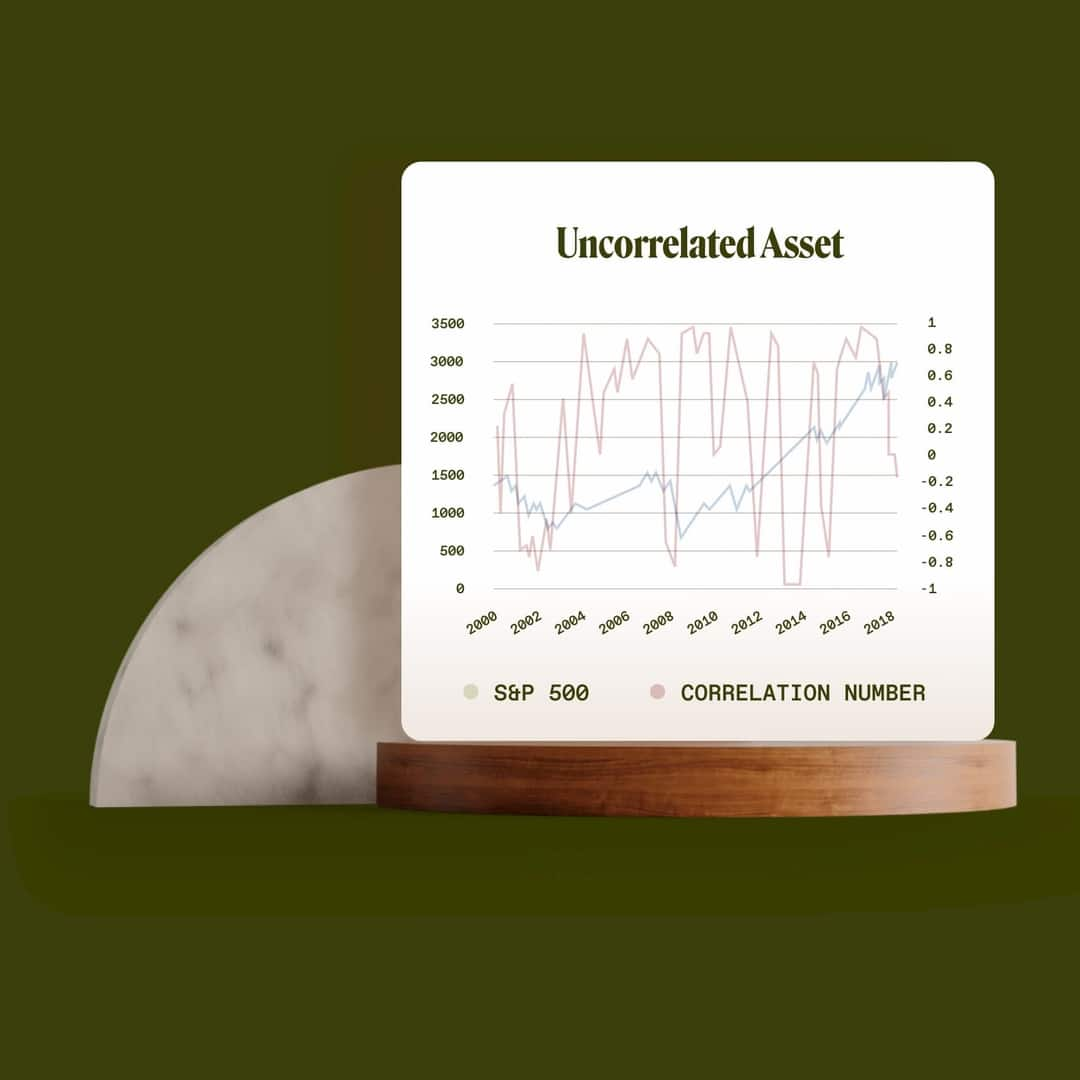

Wine is fundamentally not volatile because of the simple economic principle of supply and demand. Any batch of investible wine, say launched 30 years ago, has sequentially seen the supply of the cases go down year after year simply on account of consumption, spillage etc. and thus the remaining bottles on account of scarcity get priced at a premium. Thus Wine returns have a low correlation to traditional asset classes such as equities and bonds which are impacted by the macro economic trends.

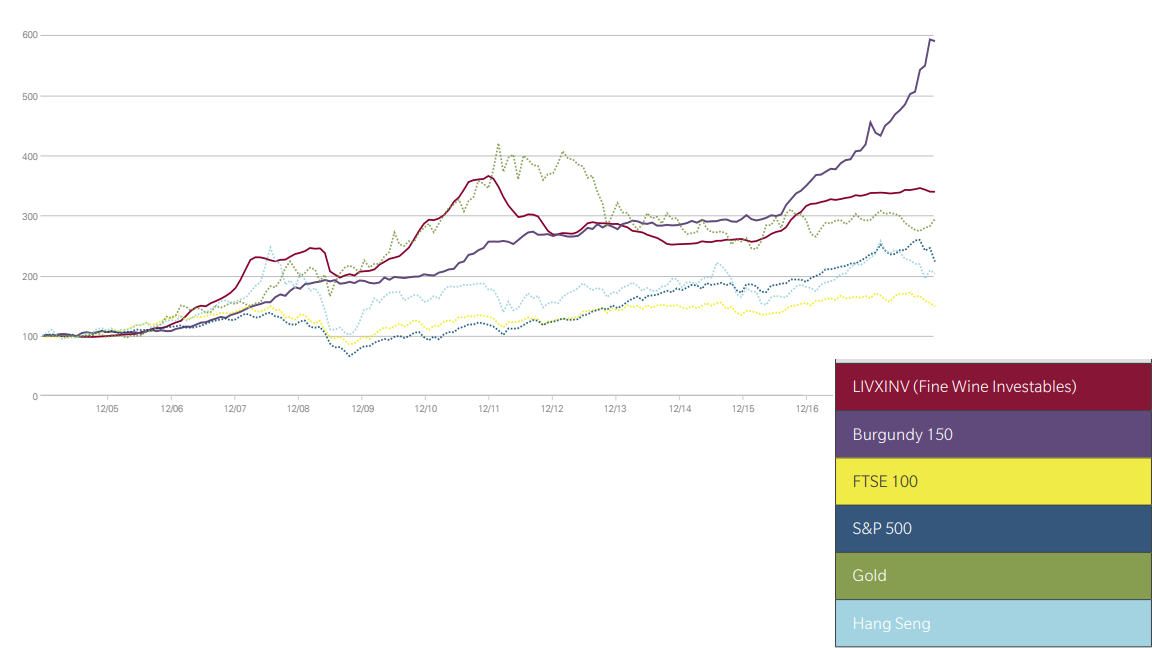

Below is the comparative return of various asset classes when compared to investible wine.

Investing in Wine, Routes: