Democratizing Investing Part 3 - Unbundling Art as an Asset Class

The above may look like "The Last Supper by Da Vinci" but it's a different interpretation of an altogether different artist. It's by Andy Warhol who was commissioned to present his version of the said masterpiece by Da Vinci.

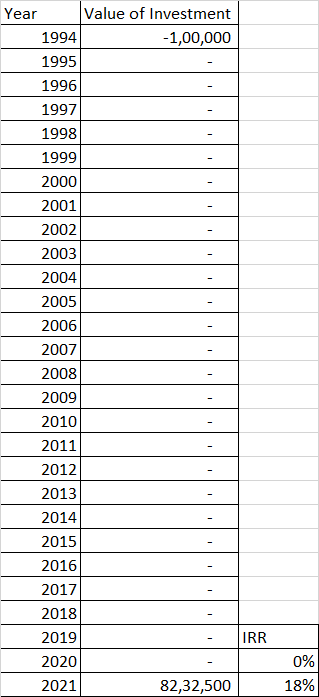

The original artwork is in a museum and is valued in 100's of millions of dollars, seemingly too much for the average Joe, but the same painted in yellow above, is far cheaper ($8.2 million at the time of writing this article, purchased 30 years ago for $100,000) but not close enough for the average Joe to invest who missed out on 18% CAGR on an investment.

This proves that the investment Options available to the ultra rich are "rich" enough for them to make high alphas (delta above public equity benchmarks) and even use these investments as expenses to be set off from the topline! Thus democratizing the retail participation by investing in Art comes 2nd to only private equity in terms of the complexity and ROI generated.

The part 1 (private equity) saw how large checks were being broken into low minimums to ensure that Private Equity, Angel Investing and Venture Capital were within reach of more investors. The simpler part was setting up a tax haven entity (structured as a hedge fund) to manage the fund pooling and investment part. The harder part is doing the due diligence on the onward investments and finding investors (co-investor funds, retail investors etc).

While the investment mode in PE is pretty much BAU (business as usual) for many investors on account of the straight forward asset ownership and liquidation options, this is where the entire value offering to the retail investors turns on its head for Art! Art is not BAU. It may take decades (or even centuries) for contemporary art to appreciate in value and for the investors to see the returns coming back to them!

This is what (fractional) investing in Art makes it a long game!

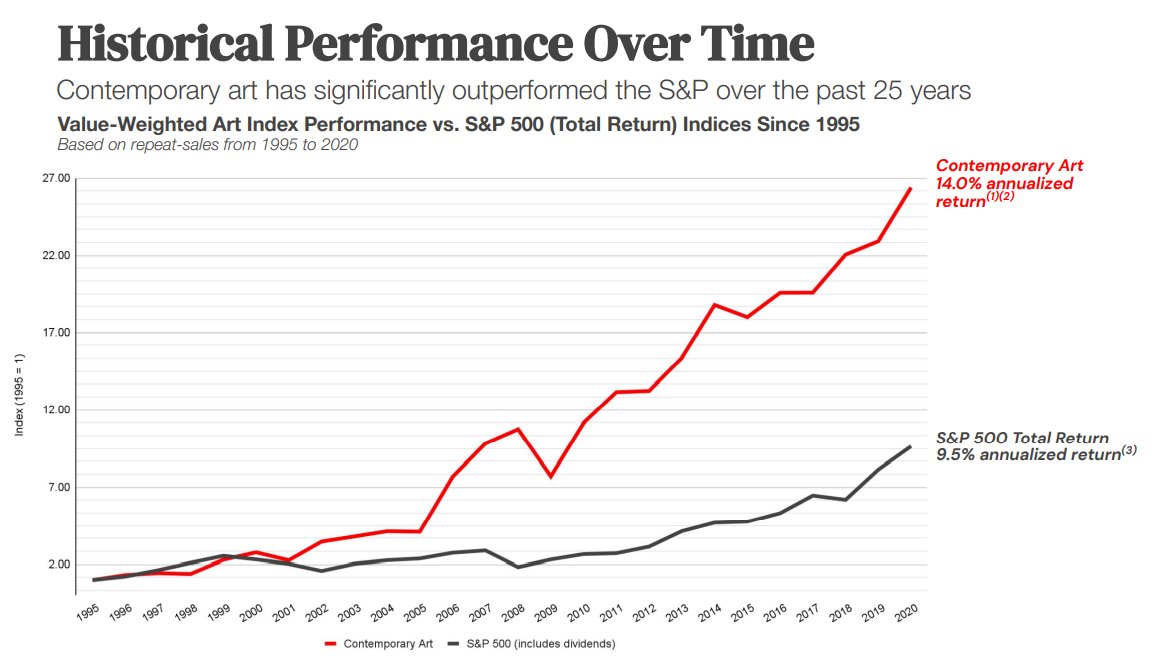

Art vs Public Equity

It is evident from the above ch"Artwork" that Contemporary (post war) art has returned on an annualized basis 50% higher returns than S&P 500 (incl. dividends). This makes investment in art an important part of one's diversification strategy when it comes to investments. But Art comes with it's own challenges of evaluating and the higher minimums (100K and above) etc.