Revenue Based Financing Business Model, Economics & Investment Rationale

Revenue based financing (RBF) is a super legacy business model that has been around since time immemorial. It officially started with the energy production and distribution businesses that would pledge the future energy generated (thereby revenue generated from those) against a current cash out option. Unofficially this dates back to the time when Oil used to come out of Whales! Whalers used to get an advance against their commitment of Oil barrels that they would hand over to the financers!

The model then would have been similar to the current world receivable financing or invoice discounting. The difference between RBF and the old world models is the fact that these are not doled out by banks and legacy financial institutions but by digital native/digital understanding investors/investor managers and the fundamental principle of no interest and no equated monthly payments.

Another major difference in the revenue based financing business model is that the type of businesses that these companies cater to. Some are sector/business agnostic and some focus on a very specific type of business. Predominantly they would be catering to SaaS, D2C/SMEs and other type of digital native brands with predictable cash flows.

The economics of this business model is pretty similar to a loan with no reducing balance, simple interest arrangement plus the facility to auto-vary (increase/decrease) the monthly instalment and pre-close at a discount rather than a penalty!

Types of Revenue Based Financing Companies

Revenue based financing in essence is present value of future cash flow but undiscounted i.e. the business owner will get the present value as a multiple of future revenues but while repaying back they would pay a multiple of the original loan amount.

For simplicity of conversation the business owner would be referred to as the borrower, the financier would be referred to as the lender.

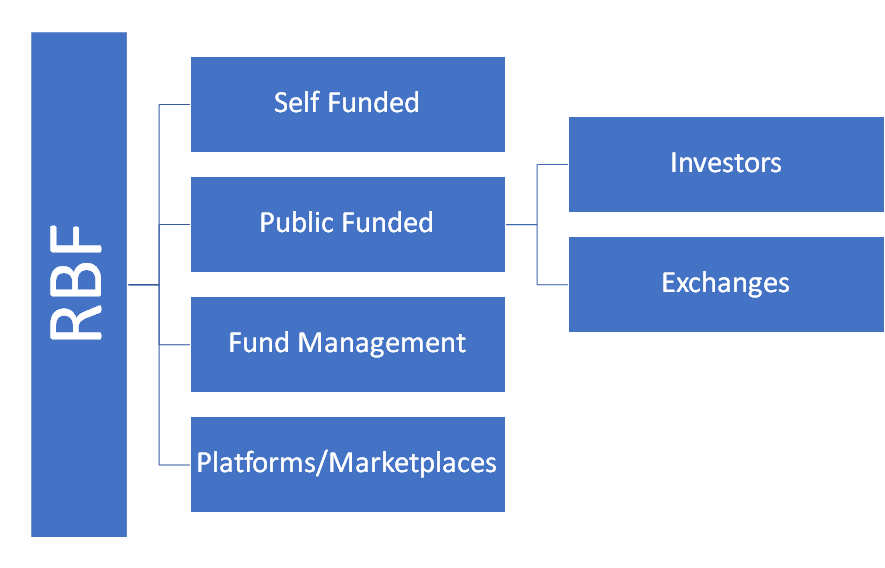

Basis the source of funds of the lender, there are 4 primary types of RBFs as below:

- Self Funded: These are the lenders that have their own book or balance sheet flush with cash that they deploy to fund operations of borrowers. These can be family offices, HNIs, venture debt providers, overseas debt (source or debt and destination of investment arbitrage between different geographies), fintech startups (with VC flushed books) etc.

- Public Funded:

- Investment Advisor: These are the intermediaries or quasi RBF lenders that provide the infra to HNIs etc. to invest their capital in the form of fixed income debt (against a fix rate of return for a fixed tenure with payouts until maturity) i.e. "RBF as a Service" against a fixed advisory fee (+ carry). Essentially this product then becomes just another asset class in the portfolio of an investor, the monitoring and collection is facilitated by the intermediary. This is a 1 to 1 platform i.e. 1 investor's 1 tranche in 1 opportunity.

- Exchanges: These are interesting intermediaries that are an investment advisor + liquidator. Basically the contract of the outstanding investment in the business can be sold off (individually or as a group of contracts - think CDOs) to other investors. The intermediary is seemingly doing something like trading contracts but more like transfer of loan from 1 lenders book to another! (Opportunity Tip: This does not exist today as of August 2021)

- Fund Managers:

- Non Risk Participation: These are the "Debt/Government Bond/Treasury Mutual Fund" equivalents of RBFs where these fund managers source low cost debt from Family offices, HNIs, Retail Investors (like Mutual Funds or ETFs) and lend it at a positive arbitrage of their borrowing rate. For e.g. These fund manager RBFs would not have risk participation from the anchor investors i.e. they would promise principal + small interest upside to the investors!

- Risk Participation: These are the VC equivalents of RBFs where these fund managers source no cost debt from Family offices, HNIs, Institutions and lend it at a high positive arbitrage of their borrowing rate (higher rate = higher risk). For e.g. These fund manager RBFs would have risk participation from the investors i.e. they would not promise the principal at all and a higher interest upside! (Opportunity Tip: This does not exist today as of August 2021)

- Platform / Marketplaces: These are the crowd funding equivalents of RBFs where these platforms just perform the curation aspect of listing the opportunities and offer this as an investment option (sachetization) to the platform investors. This is a 1 to many platform i.e. 1 investor's 1 tranche can go to more than 1 investment opportunity by pooling across many other investors tranches.